individual supply commercial property gst malaysia

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid.

The Connection Issue 21 Individual Supply Of Commercial Property Land Cheng Co Group

For instance if we take the Apple iPhones different parts are made in different countries including China and the.

. Means any goods and services tax value added tax or sales tax imposed on the sale or supply of goods services and rights including but not limited to a tax imposed by the A New Tax System Goods and Services Tax Act 1999 Cth and the related imposition Acts of the Commonwealth. What are you waiting for. In 2013 the G7s Financial Action Task Force issued the following statement in guidelines which may be applicable to companies involved in transmitting bitcoin and other currencies Internet-based payment services that allow third party funding from anonymous sources may face an increased risk of money launderingterrorist financing They concluded that this may pose.

Fees are inclusive of 15 GST but do not include the Student Services Fee course books travel and health insurance or living costs. The economy of New Zealand is a highly developed free-market economy. The globalization of the supply chains means that goods produced in one part of the globe can be transported to another part of the globe and indeed each component of the goods thus produced can be made in different countries.

People first arrived on the Australian mainland by sea from Maritime Southeast Asia between 50000 and 65000 years ago and penetrated to all parts of the continent from the rainforests in the north the deserts of the centre and the sub-Antarctic islands of Tasmania and Bass Strait. If VAT is chargeable on any Fees you shall pay the VAT amount to Grab when making payment of the Fees. Taxable and non-taxable sales.

VAT includes Goods and Services Tax GST andor similar sales taxes. The economy of Singapore is a highly developed free-market economy with dirigiste characteristics. GST is charged at 7 on the supply of goods and services made in Singapore by a taxable person in the course or furtherance of ones business and the importation of goods into Singapore.

New Zealand has a large GDP for its population of 5 million and sources of revenue are spread throughout the. The individual proprietor has the right to all the profits from the business and also the responsibility for all its liabilities. It is the 50th-largest national economy in the world when measured by nominal gross domestic product GDP and the 63rd-largest in the world when measured by purchasing power parity PPP.

If you have many products or ads create your own online store e-commerce shop and conveniently group all your classified ads in your shop. It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer. The economic liberalisation in India refers to the opening of the countrys economy to the world with the goal of making the economy more market and service-oriented and expanding the role of private and foreign investment.

PROPRIETORSHIP -- An unincorporated business owned by a single person. Goods and Services Tax GST is an indirect tax or consumption tax used in India on the supply of goods and services. If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice.

Comprehensive because it has subsumed almost all the indirect taxes except a few state taxes. Malaysia m ə ˈ l eɪ z i ə-ʒ ə mə-LAY-zee-ə -zhə. A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally.

Amounts shown are indicative only. The rate on under-construction property booking is 12. Indonesia Hong Kong South Korea Malaysia the Philippines Singapore Taiwan Thailand or Vietnam or b have obtained a license to use a on a not-for-resale version of the.

Indian economic liberalisation was part of a general pattern of economic liberalisation occurring across the world in the late 20th century. Fees paid shall be paid free of any deduction for withholding tax if applicable. PROPERTY TAX -- Group of taxes imposed on property owned by individuals and businesses based on the assessed value of each property.

31 Individual membership may be purchased by. It was announced in the 2022 Budget that this rate would be increased to 8 on 1 January 2023 and further to 9 on 1 January 2024. Come and visit our site already thousands of classified ads await you.

ASCII characters only characters found on a standard US keyboard. All GST must be paid at the time any payment for any supply to which it relates is payable provided a valid tax invoice has been issued for the supply. Hashes for cplex-22100-cp310-cp310-win_amd64whl.

The government of Malaysia under Mahathir tabled for the first reading Bill to repeal GST in Parliament on 31 July 2018 Dewan Rakyat. It is a comprehensive multistage destination-based tax. Follow these steps to create and send invoices and deal with unpaid or incorrect invoices.

All classifieds - Veux-Veux-Pas free classified ads Website. Proper invoicing helps to protect your businesss cash flow maintain good records and meet your tax obligations. Must contain at least 4 different symbols.

Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language. Is a country in Southeast AsiaThe federal constitutional monarchy consists of thirteen states and three federal territories separated by the South China Sea into two regions Peninsular Malaysia and Borneos East MalaysiaPeninsular Malaysia shares a land and maritime border with Thailand and maritime. 6 to 30 characters long.

Tax invoices sets out the information requirements for a tax invoice in more detail. The unpopular tax was reduced to 0 on 1 June 2018. Singapore has low tax-rates and the second-highest per-capita GDP in the world in terms of purchasing power parity PPP.

GSTR 20131 Goods and services tax. The history of Australia is the story of the land and peoples of the continent of Australia. Singapores economy has been previously ranked as the most open in the world the joint 4th-least corrupt and the most pro-business.

In addition to the tuition fees there is a Student Services Fee of 816 per point. Goods and Services Tax GST but well just refer to VAT GST and any local sales taxes collectively as VAT Please see this FAQ and our and our Fees Payments Policy for more information on taxes including details on the taxes Etsy collects and remits from the buyers. Its easy to use no lengthy sign-ups and 100 free.

Some countries may refer to VAT using other terms eg. Notwithstanding the foregoing sales tax goods and services tax GST or value-added tax VAT may be charged in accordance with applicable laws and regulations. GST was successfully replaced with Sales Tax and Service Tax starting 1.

All Fees shall be exclusive of Value Added Tax VAT. In this Section GST tax invoice and taxable supply have the meanings given to them in the A New Tax Systems Goods and Services Tax Act 1999 Cth.

Global Tax Changes 2022 Avalara

Integrity Hotline Konica Minolta

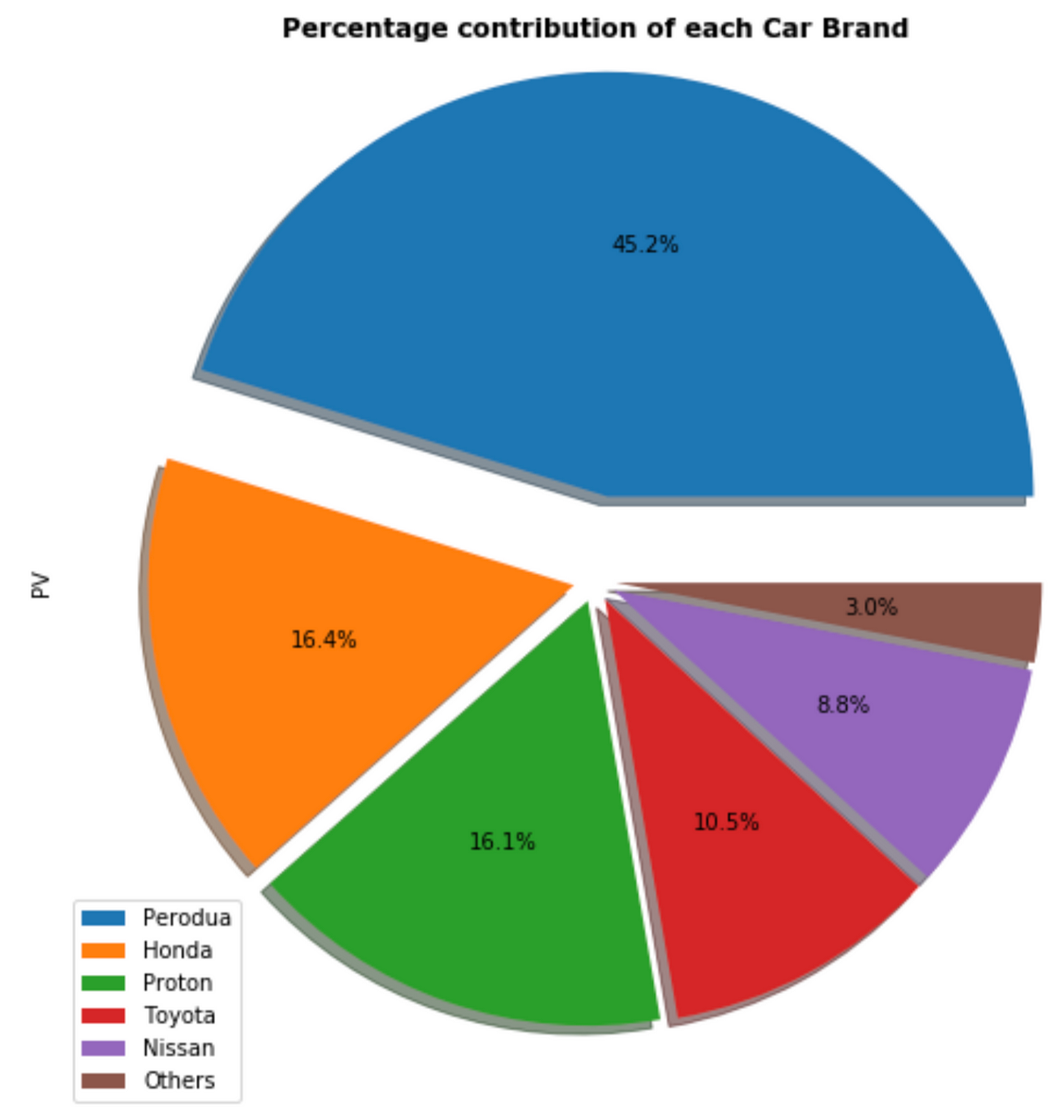

A Deeper Look Into Malaysia Vehicles Industry By Low Wei Hong Towards Data Science

Gst Hst What Does It Mean For Charities Crowe Soberman Llp

Malaysia To Impose 5 To 10 Percent Tax On Goods 6 Percent On Services

Doing Business In Canada Advantages And Disadvantages Wolters Kluwer

Buying Commercial Property In Malaysia A Complete Guide

Genuine Casio Black Watch Band F G Steel Gst B200 1a Gst B200b 1a Rubber Strap Ebay

Logistics Sector 2020 Apac Real Estate Market Outlook Cbre

Things An Owner Should Know About Gst When Investing In Commercial Properties Law Legal Articles By Hhq Law Firm In Kl Malaysia

7 Differences Between Residential And Commercial Properties Propsocial

The Connection Issue 21 Individual Supply Of Commercial Property Land Cheng Co Group

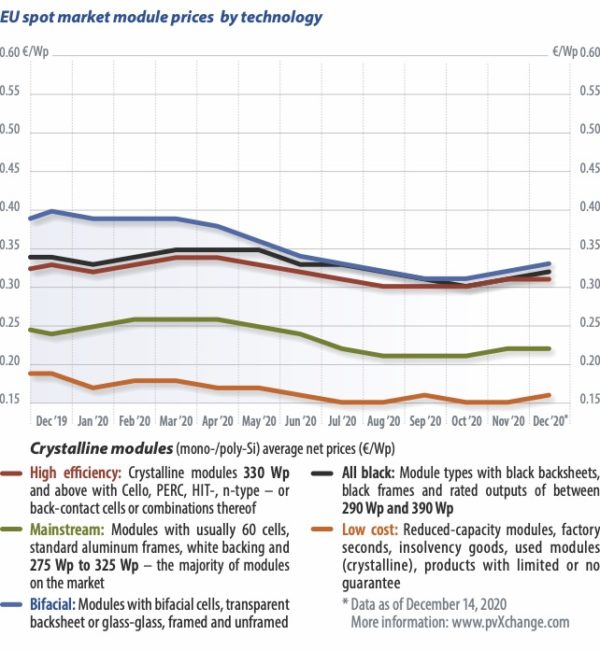

Module Price Index Pv Magazine International

Valued Insights Asia Pacific Logistics Cbre

0 Response to "individual supply commercial property gst malaysia"

Post a Comment